Financial literacy is something that I take very seriously, in large part because it’s something that took me some time to master.

Bad financial decisions in my early to mid twenties meant a few years of struggle, plenty of learning and, eventually, a determination to help my boys develop good financial habits so that they wouldn’t have to face similar problems as adults.

Of course, one of the best ways to teach is to lead by example and that’s certainly something I do.

From regularly depositing money into a savings account to searching for money-saving deals, everything adds up when it comes to effective money management.

And to help kids get started with financial literacy, try these tips on building healthy money habits:

Start Early

It’s never too early to talk to your children about financial responsibility. Start as soon as they’re able to count and make money the topic of regular family discussions.

Enjoy a fun family night with Monopoly or The Game of Life to teach the importance of making smart money decisions.

Monopoly can help children learn the importance of budgeting and setting aside an emergency fund. The Game of Life demonstrates how focusing on education can increase earning potential.

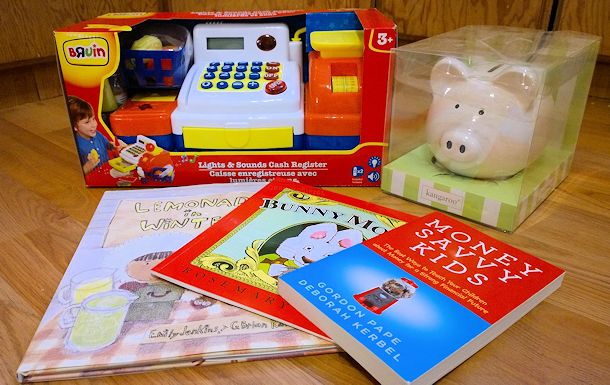

A cash register and toy store can teach them that buying goods or presents comes at a cost.

These lessons are especially important after the holiday season when they are due to receive cash gifts or gift cards – you can educate them on the importance of spending wisely in the new year.

Want Vs. Need

We’ve all heard kids proclaim they NEED a toy or new gaming console. Don’t give them everything they ask for and don’t feel guilty about it.

It’s important that children understand the difference between needs and wants, and that they may have to wait to buy something they desire.

This will help encourage them to make sensible spending decisions.

Teach Children to Save and Plan

Set up a process for saving money, whether in a piggy bank for young children or a bank account if they’re older.

Regularly monitor to see how much they’ve saved and introduce goals for saving and planning larger purchases.

If possible, look for a no-fee children’s bank account with a good interest rate, so that you can teach them that their money will grow the more they save.

Money Means Choice

Money is a finite resource, and therefore it is crucial for children to learn how to make wise choices about spending.

If your kids are young, read them a book during story time that teaches the basics of budgeting and saving. Remember to chat through lessons-learned at the end.

If you have a young adult, take a look at some basic credit cards and the rewards they offer.

Then, help them compare the potential pros and cons of the different cards, to see which one would best fit their current lifestyle.

Lead By Example

As a parent, you have a great deal of influence on your little ones, especially when it comes to financial habits.

Children have a tendency to copy their parents’ behaviour, so be open about your spending habits and savings goals, and try to limit the number of shopping trips you take as a leisure activity.

You don’t want your children to start to think money is unlimited and spending is something to do just for fun.

My youngest has finally reached a good age for being able to start understanding basic money concepts, which means it’s time for me to start teaching both my boys about proper money management in earnest.

And whether we’re reading a book about money or I’m helping them manage their allowance, there’s no question that knowledge is power when it comes to financial literacy.

That’s why starting young and staying consistent is so important when it comes to raising children to be money-responsible adults!

American express simple cash

SimplyCash™ Card from American Express® was recommended for me.

The simply cash card by American express was recommended for me

The Simply Cash card.

SimplyCash card fromAmerican Express

Market leader card

MBNA Smart Cash MasterCard Credit Card (Market Leader)

Market leader card

MBNA Smart Cash MasterCard® Credit Card (Market Leader)

I was reccommended the Market leader card