If you’ve ever received an email or letter offering you a new credit card, the offer may have included the fact that you were pre-approved or pre-qualified for the card.

These terms seem similar, and are often considered to be the same when customers receive credit card offers in the mail (or via email), but they are slightly different.

“Pre-qualified” means that your credit score is in a specific range that meets the lender’s criteria. “Pre-approved” usually means that more specific criteria were used, such as your history of on-time payments.

Before accepting one of these offers and filling out the credit card application, try using a debt payoff calculator to figure out what you currently owe on other accounts.

Once you know how much debt you’re carrying, you’ll be able to confidently decide if you want to put your application in. Here’s what you need to know:

Pre-Qualification and Pre-Approval Offers Do Not Affect Your Credit Score

When lenders and credit card issuers perform their credit checks to determine pre-qualification or pre-approval, they use a “soft inquiry,” which is a cursory check of your credit history that doesn’t affect your credit score in any way.

This should be stated clearly on the offer. Simply opening the envelope and reading it over won’t harm your credit.

Once you’re on one list as a pre-approved or pre-qualified applicant, expect to receive offers from multiple credit card companies. So, you don’t need to accept the first offer you get.

Be cautious about “limited time” offers that force you to put your application in before a certain date. There’s no need to rush if you maintain a good credit score.

Submitting an Application Does Affect Your Credit Score

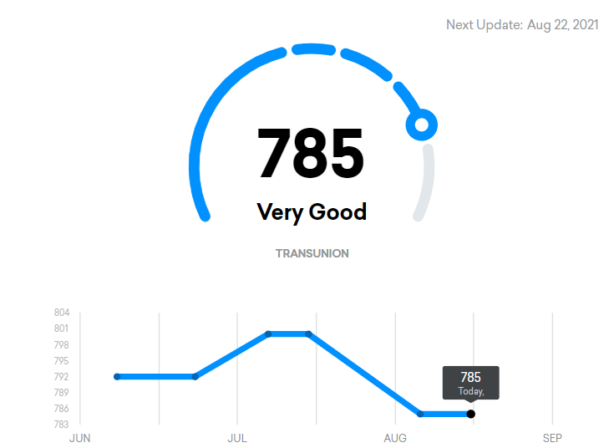

Once you fill out the application and submit it, expect to see a “hard inquiry” on your credit report. This is a deeper dive into your credit history that will cost you a few points on your credit score.

That reduction goes away quickly, but you’ll also be penalized for a “new account” when you’re approved, so bear that in mind before you push the “submit” button if you’re working on building up your credit score.

New credit is one of the variables used by FICO to calculate your credit score. It’s worth 10% of your total score, so applying for new accounts—even when pre-approved or pre-qualified—will impact your credit score.

You’ll also be taking on another set of monthly payments when you get approved, which count for 35% of your credit score.

Pre-Approval Does Not Mean You Are Approved

This is a fact that applies to pre-qualified offers also. An offer is not a guarantee of approval. That should be stated clearly on the information you receive in the mail or via email. If it’s not, investigate further.

Read the document carefully to make sure you didn’t miss anything, and call the phone number on the front to ask questions.

Another item you should look for on a pre-approval or pre-qualified offer is the APR. Some of these offers will come with an “introductory APR” that’s much lower than standard interest rates. It could even be 0%.

That’s great, but make sure you check for the expiration date and what the APR will be after that. This is especially important if you’re planning a balance transfer to help pay off your debt. Once that introductory rate expires, the interest rate will likely skyrocket.

Building up your credit score enough that you start to receive pre-approved or pre-qualified credit card offers is a solid sign you’re on the right track with managing your credit.

And when you’re ready to add a new credit card to your wallet, understanding the differences between being pre-approved vs. pre-qualified can help you make the best possible choice for your financial future.